Interview with the Outside Directors

Since June 2022, Mr. Noriaki Horikiri has been appointed as an outside director.

In this interview, Mr. Takahiko Ijichi, Ms. Ritsuko Nonomiya, and Mr. Horikiri were asked about the issues the NAGASE Group must address to realize sustained growth.

Mr. Horikiri, could you please tell us about your goals as a newly appointed outside director?

Horikiri

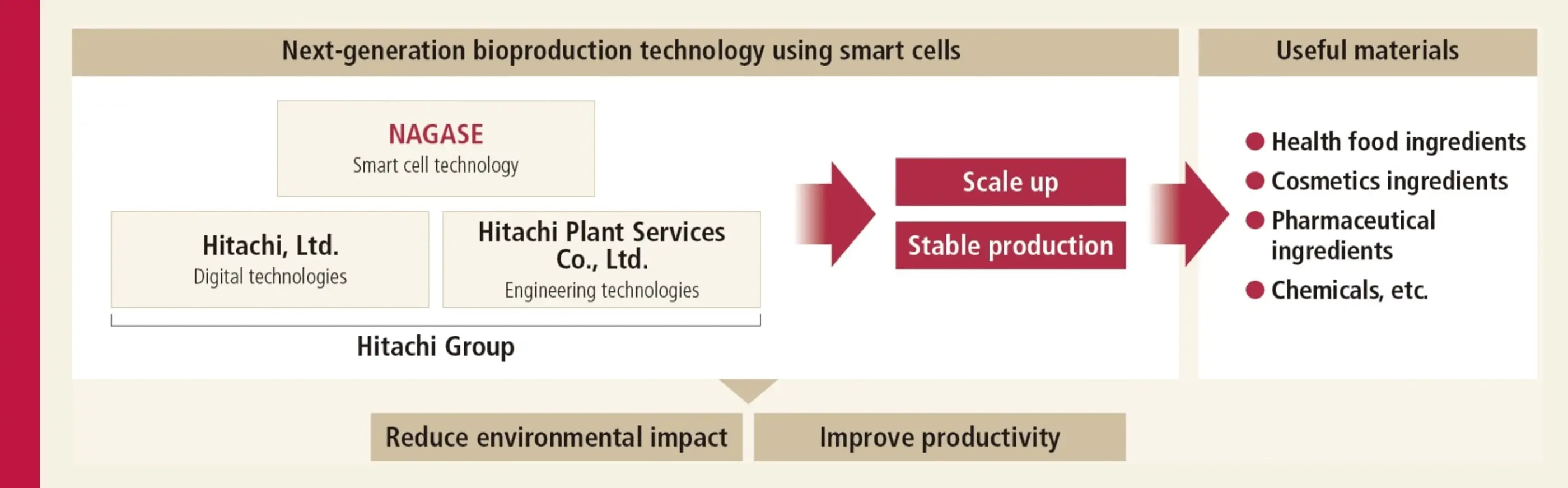

Outside directors, as the name implies, are expected to monitor the governance of a company from an outsider’s perspective and apply their experience and knowledge to the company. For many years, I worked in food manufacturing at Kikkoman Corporation. Kikkoman has anchored its brewing and fermentation technologies in biotechnologies. The NAGASE Group has been accumulating technologies in the biotechnology field, so I would like to use my experience to help the NAGASE Group grow.

Mr. Ijichi and Ms. Nonomiya, what kind of issue awareness do you maintain while attending Board of Directors meetings?

Could you talk about the points you think are positive in the last year and the ones you think are continuing challenges in the same time frame?

Ijichi

Since I was appointed as an outside director two years ago, I’ve worked to understand the values that the current management emphasizes and their problem awareness in the face of current conditions. I sometimes make forthright comments to get a sense of how serious they feel about issues and their determination. I feel that management is attentive to these types of comments too. I develop a full understanding of the background and discussions that occur before each agenda item is presented to the Board of Directors and I determine whether those measures are really sustainable from an accounting and personnel standpoint. I discuss matters to ensure that “what the numbers really say” is not overlooked.

Nonomiya

Following the dramatic changes in the business environment due to the COVID-19 pandemic, the agenda items for Board of Directors meetings now cover a lot more ground than they used to. While I may not be familiar with all of the agenda items, I make it a point to do my best to understand each one so that I don’t approve a proposal I don’t understand or reject one simply because I don’t understand it. The NAGASE Group provides outside directors with advance briefings on agenda items, and the content of those briefings is also reported to President Asakura and reflected in the Board of Directors’ discussions. I believe that the discussions in advance briefings lead to deeper discussions in the official Board of Directors meetings and help to enhance the directors’ effectiveness.

Ijichi

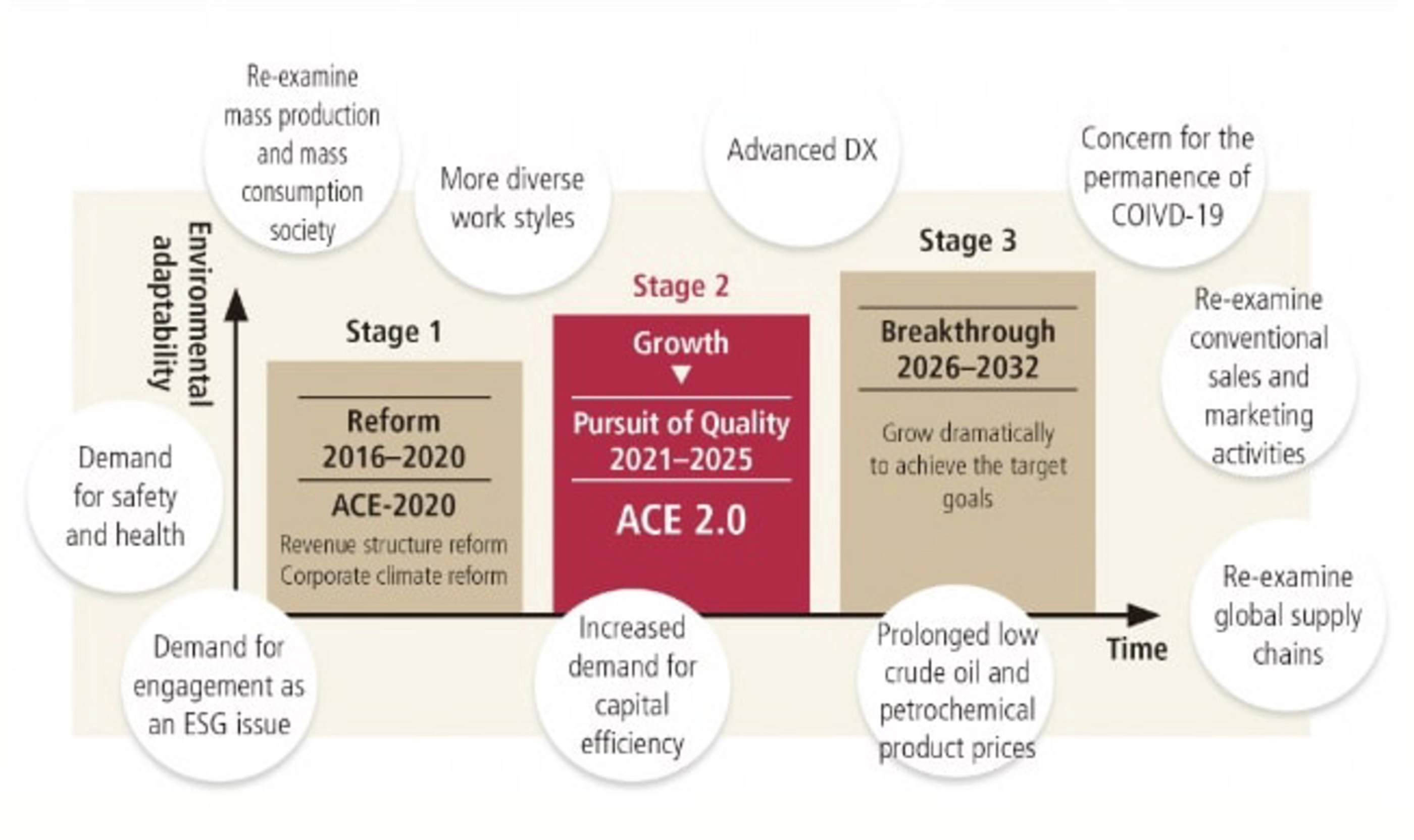

Under President Asakura’s leadership, the NAGASE Group Board of Directors is able to hold free and open-minded, in-depth and interactive discussions. Young employees who brief the Board members on projects properly express their own opinions, and the chairman and vice chairman pay attention to those briefings as well. Since the announcement of the medium-term management plan ACE 2.0 in 2021, I’ve felt that top management is strongly determined to shed the clothes of the old NAGASE & CO., LTD., so to speak, and transform the company at any cost. Over the past year, I’ve also noticed that their determination has permeated the whole company as a result of discussions in Board of Directors meetings. If I had to raise a concern, it would be horizontal coordination within the organization. Because the NAGASE Group values business division autonomy, the vertical dimension is well-coordinated. However, in order to successfully advance global business expansion in the future, it will be critical to strengthen the functional dimension in the horizontal direction even further. For example, on the corporate level, functions like human resources, accounting, quality, and safety should be reinforced. Doing so is difficult because it involves corporate culture, but I believe it is a core issue.

Nonomiya

The NAGASE Group has an excellent corporate culture and DNA, and I’m particularly impressed that this culture and DNA have been passed down to younger generations of employees. Furthermore, I believe the company is forthright and honest about the need for transformation. That said, while it is important to share each other’s values, it can be problematic because if you see things from the same perspective, you can only express the same opinion. The appointment of outside directors, as well as promoting the success of women and diversity in the workplace, are crucial. However, I believe that a key consideration in accelerating growth is how many people with opposing viewpoints can be brought together and whether they can discuss their differences.

Horikiri

Similarly to Kikkoman, which has a 300-year history, the NAGASE Group is a family-run company with a nearly 200-year history. The greatest risk to the governance of family-run companies is succession planning, and how to interact with the founding family. In terms of appointing a person in charge of management who is appropriate for the times, I believe that the NAGASE Group is addressing this challenge under President Asakura’s leadership by distinguishing between what should and should not be changed. With mounting calls to strengthen governance in recent years, outside directors have assumed increased roles and responsibilities. However, governance must not succumb to empty formalism. We should consider more than just the number of outside directors, but also the positioning of outside directors in a substantive manner.

Ijichi

The NAGASE Group has stood apart from the social trend of emphasizing the SDGs and ESG. I believe that the Group decides what it should do on a case-by-case basis and acts accordingly. I’m impressed by the Group’s stance of considering what is truly in the company’s best interests and making decisions based on that, rather than getting caught up in fads in society.

Nonomiya

People will demand that companies maintain a sense of balance as they strengthen their governance in the future. The good thing about the NAGASE Group’s governance, in my opinion, is that it is not preoccupied with formalities.

Could you please discuss the main points the NAGASE Group needs to address to support its growth?

Nonomiya

In order to accelerate growth, it is necessary to correctly understand which factors pose risks. Outside directors play a role in providing monitoring. To help the company grow positively, they should ideally be able to support the company as it ambitiously works toward the next stage of growth, while also understanding the risks that the company faces. They shouldn’t just tell it to not to do this or that. I read the interim report on digital transformation (DX) and gave it high marks. In addition to early investments and the CEO’s commitment, the company has incorporated the advice of external experts and is implementing a global roll-out. From the standpoint of an outside director, these factors demonstrate that the company is making a very good effort. In terms of M&A, I’m pleased that the company has achieved additional growth by making a significant investment in the Prinova Group LLC. With that said, I believe that portfolio management is a critical issue that management must address continuously.

Ijichi

The first point is that the company has set clear targets in ACE 2.0, so all that remains is to execute what needs to be done thoughtfully in accordance with its specific roadmap while implementing PDCA cycles. If the company is unable to complete this task, the vision we have outlined will not be realized, but I think the NAGASE Group can execute measures properly. The second point is that I would like the NAGASE Group to consider DX to be a functional dimension. President Asakura has made a top-down decision to appoint talented human resources in each division as DX leaders. As a result, I believe that the NAGASE Group can transform itself into an organization capable of integrating operations across divisions. In order to transform the NAGASE Group’s culture and business model in earnest, I would like the company to see DX as more than just a technology and develop it into a cross-organizational capability with a functional dimension.

Horikiri

I believe that determining how it can horizontally integrate individual businesses and turn them into growth drivers is a key priority for the NAGASE Group, which has many business fields. As Ms. Nonomiya mentioned, portfolio management will also be crucial. I have the impression that the key to sustained growth will be to grow by constantly repeating the process of choosing good businesses and rejecting bad ones.

Ijichi

The brand power of the NAGASE name, in my opinion, is highly significant. When considering the next 100 years, branding strategy will be critical, and I hope that the company will use the NAGASE name skillfully.

Profile

Integrated Report 2022

Download Separate Files

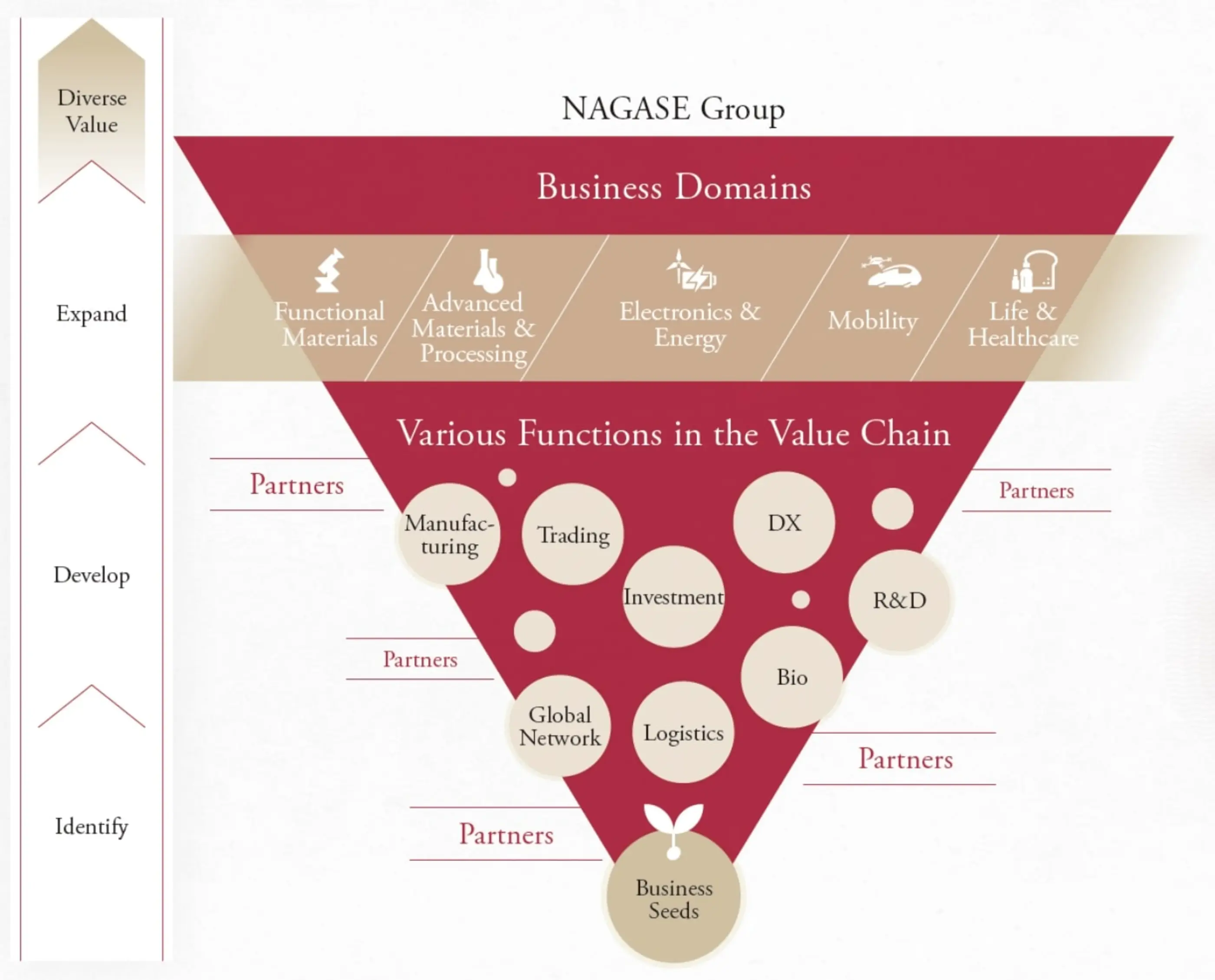

WHAT / The NAGASE Group’s Strengths | Our Significance | History of Value Creation | Our Business Model | Important Management Resources | HOW / The NAGASE Group’s Growth Strategy | Overview and Progress of the Medium-Term Management Plan| [Feature] The Food Ingredients Business Led by the Prinova Group | [Feature] Holding the Key to Growth through NAGASE’s Biotechnology | WHERE / The NAGASE Group’s Ideal Future | Message from the General Manager of the Corporate Sustainability Dept. | Our Sustainability Initiatives | Materiality and KPIs | Corporate Governance | Compliance | Risk Management | Interview with the Outside Directors | Creating Environmental Value | [Feature] Contributions Toward Decarbonization in the Supply Chain | Creating Social Value | [Feature] NAGASE’s Organizations to Promote DX | Social Contribution Activities

Message from the Director in Charge of Sales | List of Businesses | Functional Materials Segment | Advanced Materials & Processing Segment | Electronics & Energy Segment | Mobility Segment | Life & Healthcare Segment | Regional Strategy

Our Board | 11-Year Financial Highlights | Non-Financial Highlights | Financial Information | Consolidated Subsidiaries, Affiliates and Offices | Investor Information | Corporate Information