CFO Message

Balancing Base Businesses with Focus and Develop Businesses to Shift to a Robust Profit Structure

Review of the First Year of ACE 2.0 from a Business Portfolio Perspective

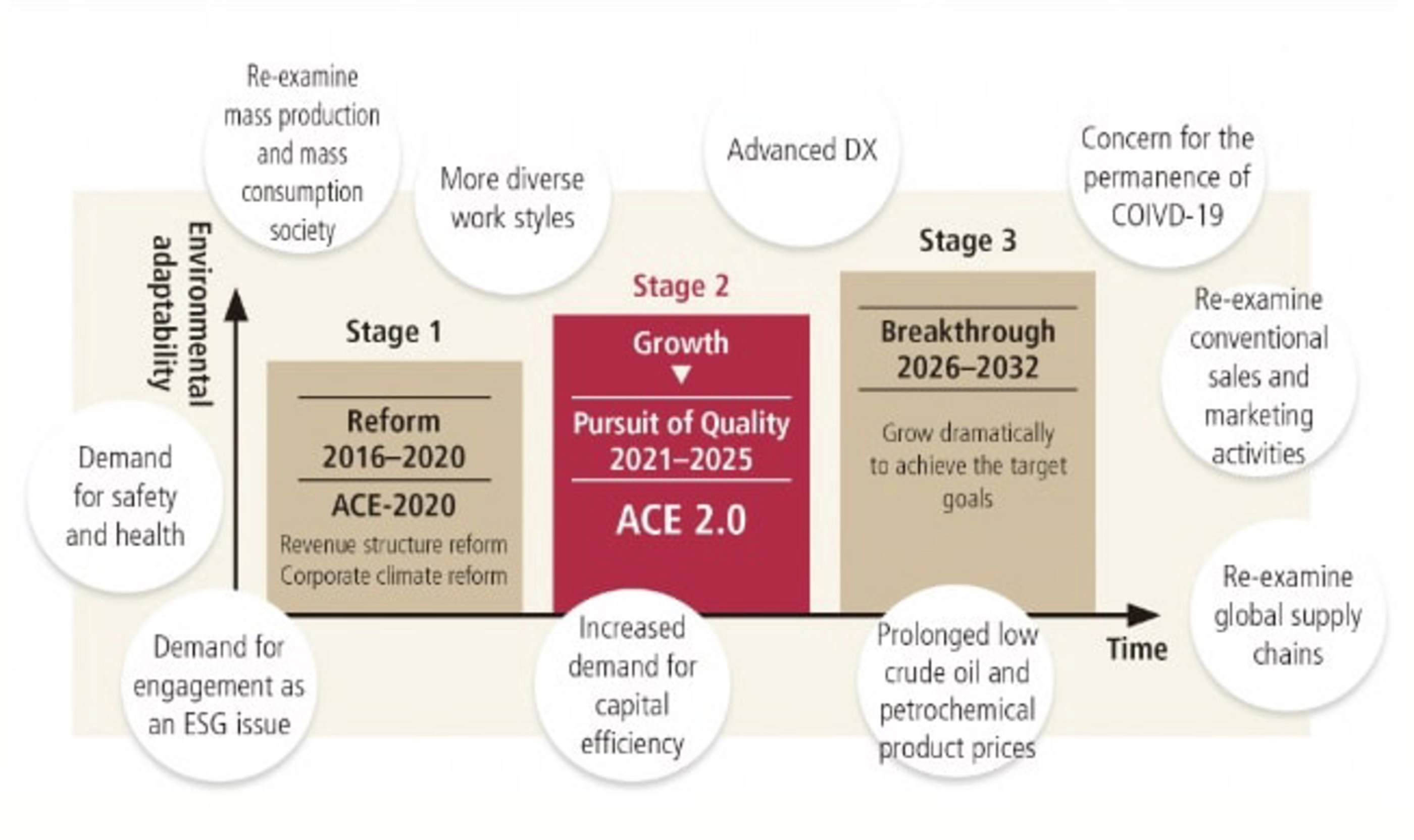

The first year of ACE 2.0 was a phase in which we tried to move forward while reassessing our platforms and foundations. In doing so, we sought to augment our fundamental strengths to ensure the NAGASE Group’s sustainable growth. Our results grew, but our analysis shows that this growth was primarily due to the impact of tailwinds such as rising market prices. Keeping this in mind, I can proudly state that the source of our profits was that we continued to maintain the highest standards of integrity, which meant that we served our customers with the utmost sincerity in the face of drastic changes in the external environment, and that we firmly kept our promises.

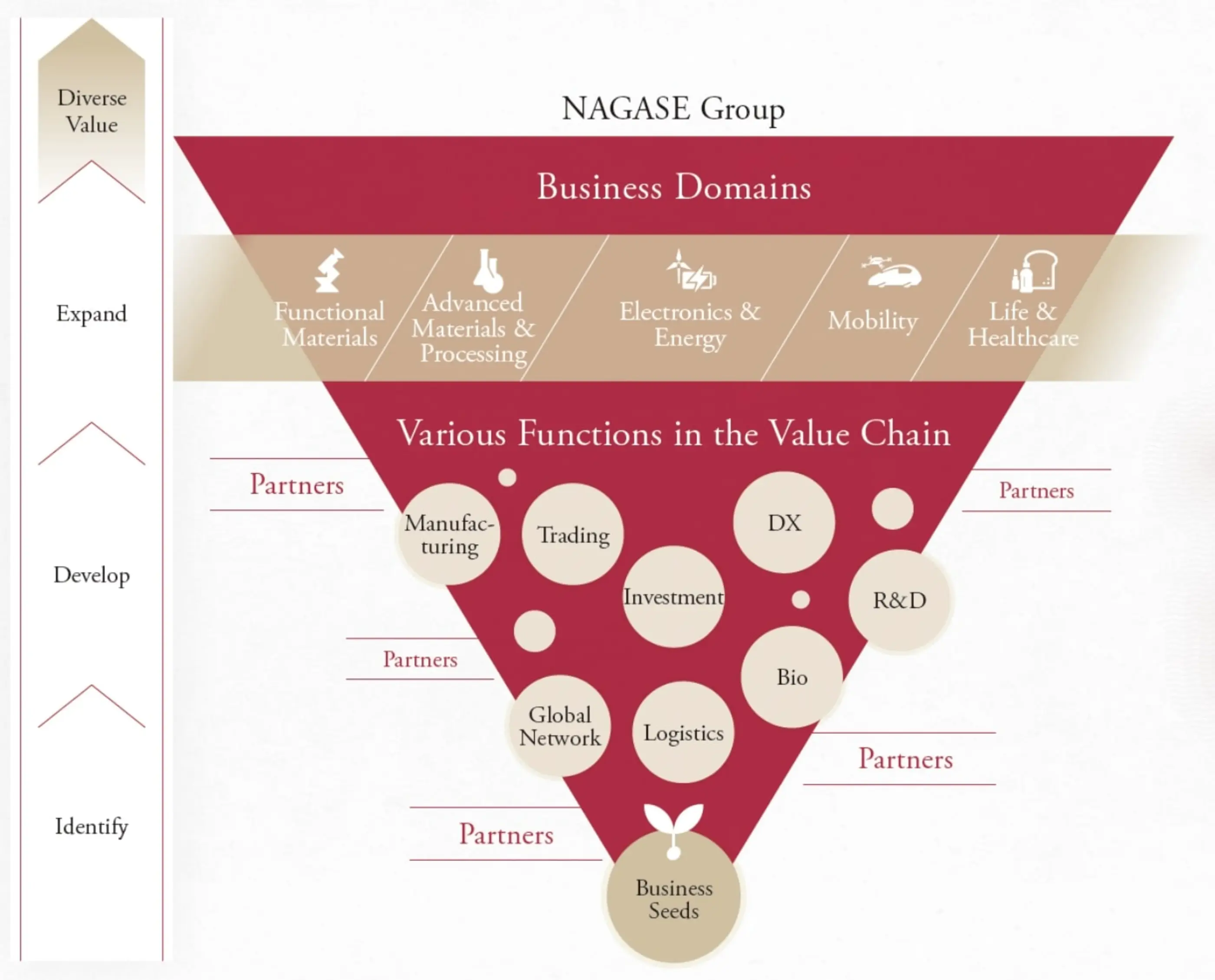

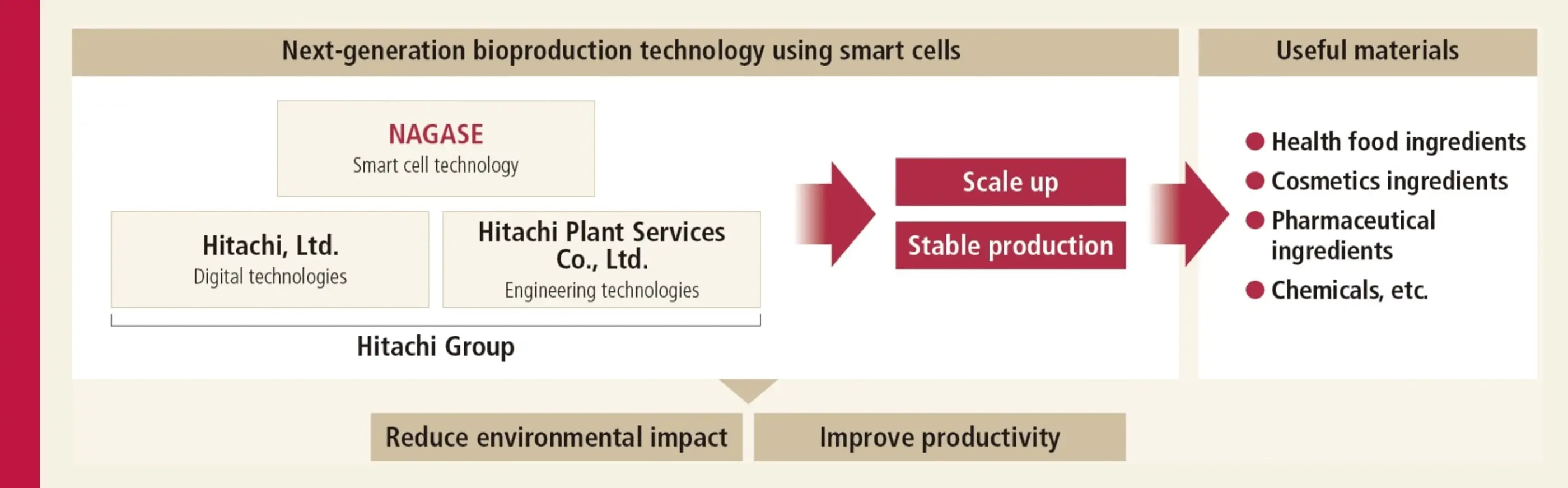

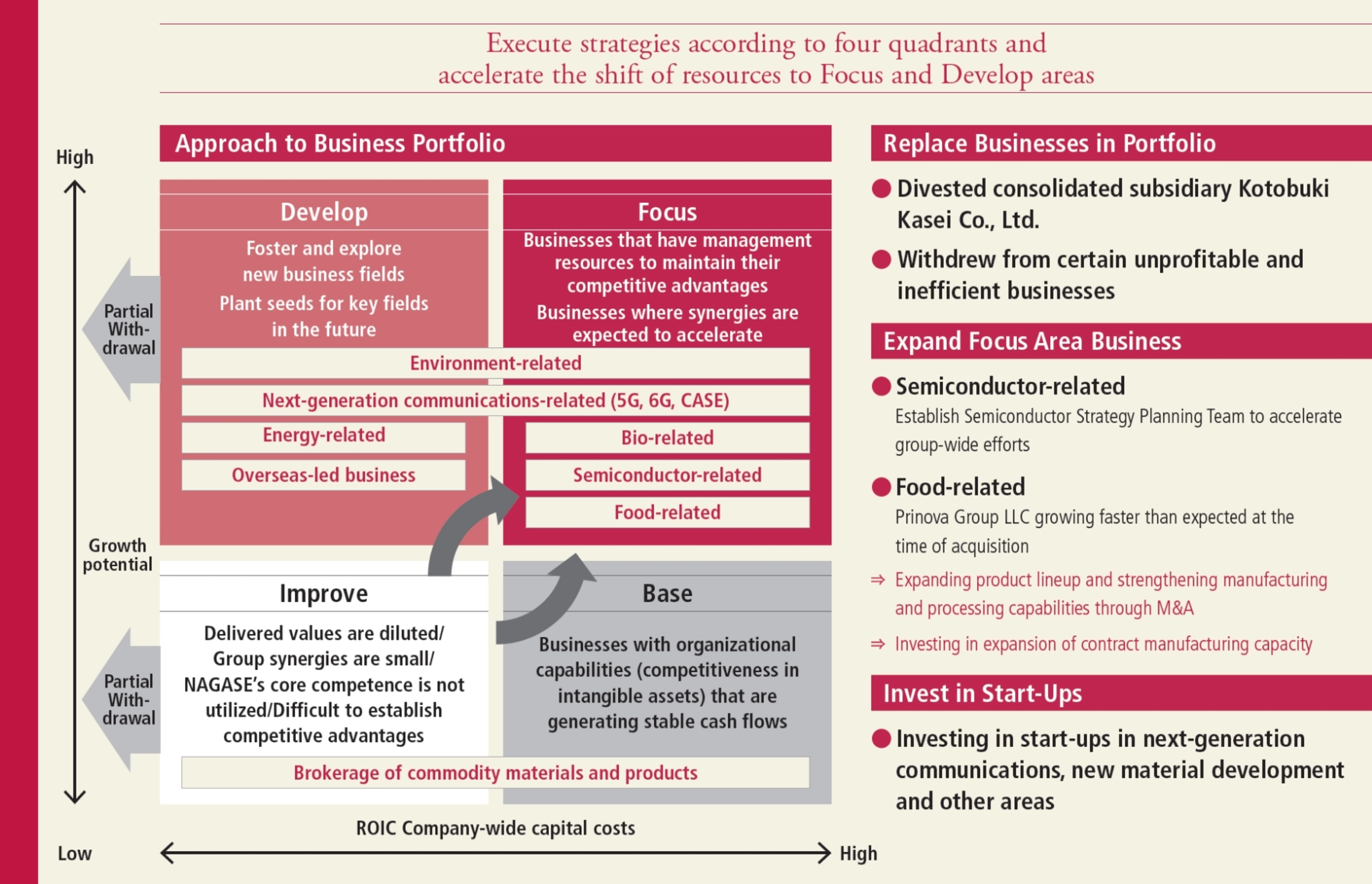

In the past year, we have started to recognize that the next stage of our future lies in the continuation of the steadfast efforts we have continued to make since the previous medium-term management plan ACE 2020. The NAGASE Group has classified its diverse business portfolio into four quadrants, specifically the Improve, Base, Develop, and Focus areas based on the two dimensions of growth potential and capital costs. While the chemical and resins businesses are carefully managed in the base area, capital will be intensively allocated to the focus and growth areas, with the aim of continuing to drive growth. The focus areas for ACE 2.0 have been defined as the bio-related business, semiconductor business and food ingredients business. The replacement of businesses in the portfolio has been progressing because we have increased capital allocation to those businesses from the plan’s first year.

We have long concentrated our efforts in the semiconductor field. Going forward, our main priority in this field will be to turn it into a highly profitable business. The NAGASE Group supplies materials such as epoxy resins, which are deeply embedded in the semiconductor manufacturing process, and we intend to establish a solid business foundation in the semiconductor industry. Notably, China is a massive market on which we should concentrate our efforts. Although conditions are volatile due to factors such as U.S-China friction, we have a strong belief that the semiconductor business that we have worked so hard to develop will finally begin to flourish in China. Meanwhile, Japanese companies provide 60–70% of the manufacturing process technology in the U.S. semiconductor market. Concerns about China will likely hasten the shift of production to the U.S. Because Japanese companies have strengths in equipment and materials, I believe that demand for Japanese semiconductor equipment and materials will increase further in the U.S. While the company will continue to have high expectations for China, I believe that determining how we will enter the U.S. semiconductor industry will be one of our challenges going forward.

The food ingredients business is one of the signature reforms of ACE 2.0. We acquired the Prinova Group at the same time that we were solidifying our base with the acquisition of Hayashibara Co., Ltd. and these actions demonstrated our presence both in Japan and abroad. In Prinova-related areas, besides the two business acquisitions, we established a sports nutrition manufacturing plant in the state of Utah in the U.S., and business is expanding. The addition of sports nutrition as a new category has significantly increased the NAGASE Group’s earnings.

Prospects for Achieving ROE Target and ROIC as a Decision-Making Indicator

Under ACE 2.0, we set a target for achieving return on equity (ROE) of 8.0% by fiscal 2025, the plan’s final year (actual ROE for fiscal 2021: 7.7%). In addition, we intend to achieve a return on invested capital (ROIC) that exceeds the weighted average cost of capital (WACC). While there are many issues that need to be resolved, I am confident that we will meet our ROE target of 8.0%.

Meanwhile, under ACE 2.0, we adopted ROIC as one of our indicators for management decisions. We are dividing our existing businesses into smaller pieces with an eye toward ROIC and carefully considering how we will replace businesses in the portfolio. Businesses that can provide high added value, for example, will be transferred from the Base area to the Focus and Develop areas. We will not immediately withdraw from important businesses, such as core businesses that support NAGASE’s technologies, simply because they have a low ROIC, but will instead aim to improve their ROIC first.

In fiscal 2021, ROIC improved from 4.2% to 5.3%. Working capital increased, causing an increase in invested capital. We will work to optimize invested capital by maintaining strict inventory control. In addition, WACC fell from 5.7% to 5.5%. Overall, operating income, one of the quantitative targets of ACE 2.0, reached ¥35.0 billion. However, we recognize that we continue to face efficiency issues, so we intend to promote the “Pursuit of Quality” in this area too.

We consider ROIC to be a preliminary indicator for investment decisions such as prioritizing invested capital and replacing businesses. Efforts are being made to raise awareness of this principle throughout the company. We have already established a system for calculating the ROIC of businesses at a certain level, and have begun monitoring operations with BI tools*. As we move forward with ACE 2.0, I’m convinced that ROIC-based thinking will gradually permeate our organization.

* Business Intelligence tools: Software that collects vital information from a company’s vast amount of data, and analyzes and visualizes it so that it can be used to help management and business operations

Honing Businesses Through Asset Replacements

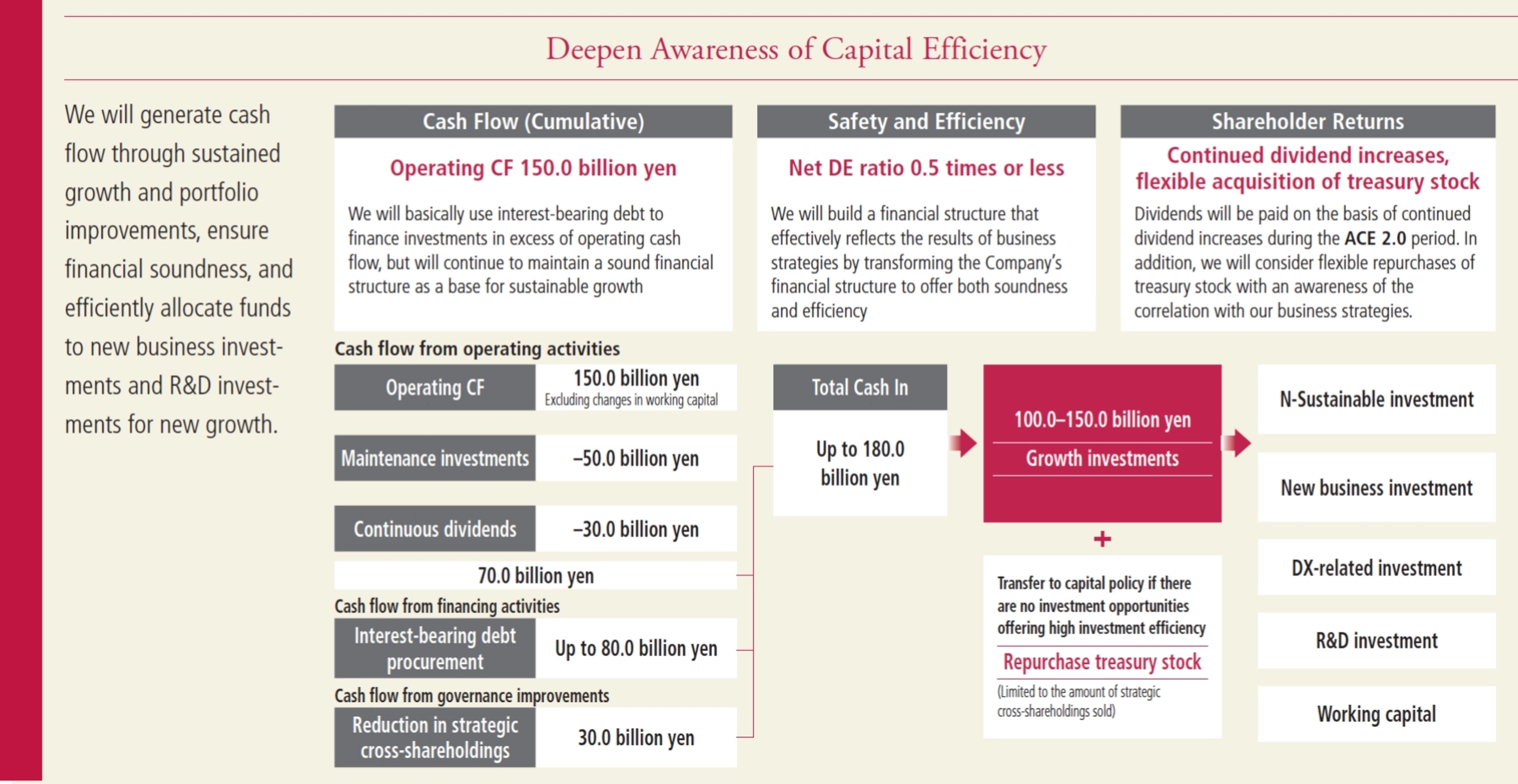

We will continue to increase new investment projects, in part to strengthen the NAGASE Group’s ability to generate ideas and its ambitious spirit. Under ACE 2.0, we have set a strategic growth investment limit of ¥150.0 billion and intend to make these investments over the next 5 years. We plan to replace 10% of our assets with assets in Focus and Develop areas that offer high ROIC and growth potential.

I’m also aware that M&A will be critical in our efforts to enhance our manufacturing business. While our ROIC is our primary investment criterion, we also have businesses that should not be decided solely based on ROIC, such as specific core businesses that are essential to maintaining and expanding our customer base. I believe that one of my most important roles as CFO is to make appropriate decisions on such businesses, while keeping the NAGASE Group’s medium- and long-term growth prospects in mind.

Turning to shareholder return measures, we have conducted share buybacks, which we had not done before, for the past two consecutive years, as part of our efforts to shift away from shareholder returns centered on dividends. The total return ratio, which is the sum of dividends and share buybacks, is expected to surpass 40%. In terms of measures to bolster our capital structure even further, we will seek to reduce strategic cross-shareholdings by ¥6.0 billion per year, with plans to reduce these cross-shareholdings by ¥30.0 billion over the 5 years covered by ACE ACE 2.0. We have already begun to steadily reduce strategic cross-shareholdings and will continue to do so.

The Mission of the Group Manufacturing Management Innovation Office

On April 1, 2022, we established the Group Manufacturing Management Innovation Office as a new head office organization. This office grew out of efforts to enhance the Group Manufacturers’ Collaboration Committee, which was formed in 2019 to bolster the foundation of manufacturing companies in the NAGASE Group.

Manufacturing businesses account for almost half of the NAGASE Group’s profits. Manufacturing businesses’ scale and influence within the whole Group have grown year after year, as has their share of our consolidated results. Meanwhile, I had the impression that our ability to coordinate our manufacturing businesses was lacking. Our manufacturing businesses did not share a common language or culture, nor did they have common goals. Therefore, we launched this organization with the aim of enhancing our Group’s collective capabilities.

Our goal is not to control the Group’s manufacturing companies. Instead, it is to encourage each company’s individual growth while also building a common platform to improve our collective capabilities.

First, we will assess current conditions from a management viewpoint so that the manufacturing companies can discuss their diverse values and benchmarks in a common language, ensuring that the Group’s manufacturing businesses create new value. Specifically, we started by evaluating the value chains of Group manufacturing businesses, from development to production and quality assurance activities, identifying common management indicators, and attempting to understand and standardize diverse manufacturing processes.

Group companies have already expressed their anticipation and enthusiasm for these initiatives. We see this as a crucial opportunity to strengthen the NAGASE Group further.

Continue to Maintain the Highest Standards of Integrity and Demonstrate the Value of the NAGASE Group

The NAGASE Group must be a sustainable company if it is to continue to be chosen by its stakeholders. We must continue to promote the businesses that will lead to sustainability that we are currently pursuing, as well as gain the empathy of all stakeholders for the NAGASE Group’s raison d’etre. To achieve these goals, we must also build a robust earnings base while properly replacing assets and continuing to provide sustainable added value to society.

As I said I earlier, I believe that one of the most important things that the NAGASE Group should emphasize is the importance of maintaining the highest standards of integrity in each employee. We would not have been unable to establish a presence within supply chains if we had not acted with the utmost sincerity so far. We would have lost touch with NAGASE’s identity if we had not maintained the highest standards of integrity. Without this spirit, we will be unable to celebrate our 200th anniversary in 2032. We must always maintain the highest standards of integrity. Keeping these words close to our hearts, we will continue to demonstrate the NAGASE Group’s raison d’etre to society.

Update:

Hayashibara Co., Ltd. changed its corporate name to Nagase Viita Co., Ltd. as of April 1st, 2024.

Integrated Report 2023

Download Separate Files

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy

dummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummydummy